Employment Law Update

June 2014

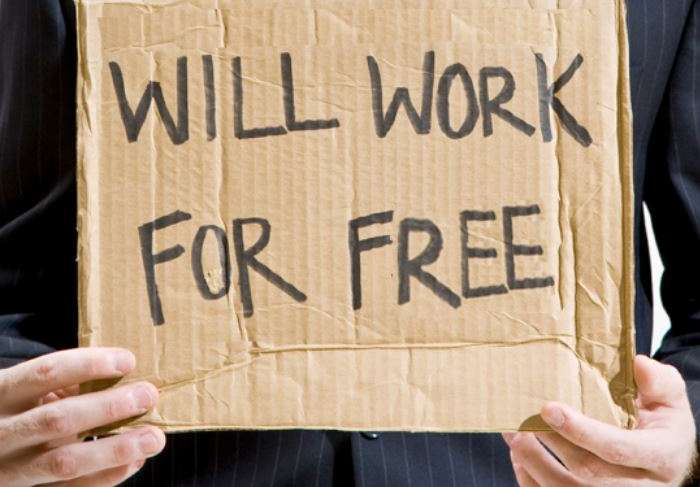

This Client Alert affects all businesses that employ “unpaid interns” for summer or seasonal work and their potential liability for minimum wage and overtime claims under the Fair Labor Standards Act (FLSA) and related Ohio laws.

On June 11, 2013, in Glatt v. Fox Searchlight Pictures, Inc., a NY federal district judge held that two individuals working on the set of the film Black Swan had been improperly classified as unpaid interns. As a result, both individuals were entitled to wages under the FLSA and its NY equivalent. Using the six criteria set out in an April 2010 U.S. Department of Labor fact sheet on internship programs under the FLSA as a guide, the court found that the interns worked “as paid employees work,” providing an immediate advantage to their employers and receiving nothing approximating the education available in an academic setting or vocational school.

Moreover, the benefits the interns did receive – such as knowledge of how a production or accounting office works or references for future jobs – were gained by “simply having worked as any other employee works.” In this situation, the internships were not designed to benefit the interns or to be “uniquely educational,” but instead required the interns to perform “routine tasks that would otherwise have been performed by regular employees.” Therefore, the interns’ positions did not fall within the “narrow ‘trainee’ exception to the FLSA’s broad coverage,” and these “employees” were entitled to wages just like any other staff

This issue has potentially extensive implications for any employer who utilizes unpaid interns. Dozens of unpaid intern cases have been filed in the last year including high-profile lawsuits against Gawker Media LLC, Elite Model Management Corp., Condé Nast, NBC Universal, Warner Music Group, Madison Square Garden, and the Hearst Corporation. Although many of these cases arise out of the entertainment industry, the relevant rules and standards are applicable to any employer.

In addition to intern-related lawsuits, state and federal agencies have also increased their efforts to administer wage and hour laws relating to unpaid internship positions and programs. Enforcement has increased because (i) unpaid internships are increasingly popular and (ii) individuals who are most affected are students and recent graduates who are either unable to speak up and/or do not want to jeopardize their chances at regular full-time employment. Federal and state agencies are more frequently starting their own investigations and fining employers who are not properly following federal and/or state wage and employment laws.

Importantly, any related wage and hour liabilities will be applicable even if the individual “voluntarily” declines compensation for any position or work. As such, an employer will not be insulated from risk just because the individual has agreed to be unpaid intern.

It is essential to remember to follow the six-factor test developed by the DOL whenever an individual is employed without compensation.

If you have any questions or would like to discuss the case summarized in this Client Alert in more detail, please do not hesitate to contact us.